.webp)

.webp)

.webp)

.webp)

An Assignment of Benefits (AOB) is a straightforward legal agreement. It lets a policyholder transfer their insurance rights over to a third party, like a contractor or a doctor. This simple transfer allows the provider to bill the insurance company directly, taking the policyholder out of the middle.

Think of it this way: you're giving the service provider permission to stand in your shoes when it's time to talk to your insurer. For example, a homeowner might sign an AOB with a roofer after a hailstorm. The roofer can then immediately begin repairs and bill the homeowner's insurance company directly, rather than the homeowner paying upfront and seeking reimbursement.

An assignment of benefits agreement is a tool designed to make life easier after something goes wrong. Imagine your car gets banged up in an accident. Instead of shelling out thousands for repairs and then waiting for your insurance company to maybe, eventually, reimburse you, you sign an AOB with the body shop.

That one signature gives the shop the legal authority to deal directly with your auto insurer for payment. You get your car back without the upfront financial headache, and the shop takes on the fight for payment. The whole point was to get consumers the help they need now, without forcing them to drain their savings first.

This same idea applies across the board, from roofers fixing storm damage to physical therapists treating injuries after a fall.

Every AOB agreement has three main parties, and understanding their roles is the first step to seeing how these documents really work.

To make it clear, here’s a quick breakdown of who’s who in a typical AOB. For instance, in a medical context, the patient is the assignor, the hospital is the assignee, and the health insurance company is the insurer.

This simple contractual shift moves the entire payment conversation from the policyholder's shoulders to the provider's. It's a fundamental change in who deals with the paperwork and the follow-up.

While born from a need for convenience, the assignment of benefits has become a lightning rod for controversy, especially in certain states. The concept isn't new—its legal roots in Florida go all the way back to a 1917 state Supreme Court ruling, West Florida Grocery Co. v. Teutonia Fire Ins. Co. But its use exploded in recent years.

Consider this: according to data from the Florida Department of Financial Services, the number of AOB-related lawsuits in the state shot up from just 408 in 2000 to over 28,000 by 2016. That kind of surge completely reshaped the state's insurance market. If you want to dig deeper into this trend, Verisk.com offers a great overview of AOBs and their growing concern.

This explosion really highlights the two-sided nature of AOBs. On one hand, they give people a lifeline to get immediate, necessary services. On the other, they can spark huge fights over billing, repair costs, and who truly controls the claim—making sharp legal oversight more important than ever.

An assignment of benefits is a binding contract that has to stand up in court. For an AOB to actually work, it needs to be built on solid legal ground, following the same basic rules as any other contract.

At its core, an AOB is a transfer of rights. The policyholder must give clear, unambiguous, and informed consent. For example, a patient signing forms in a hospital emergency room must clearly understand they are assigning their insurance payment rights for that specific visit to the hospital. A vague or confusing document is a non-starter; the intent to assign the benefits has to be crystal clear.

Of course, like any contract, there needs to be an exchange of value: what lawyers call "consideration." Let's say a roofer agrees to fix a storm-damaged roof. In exchange, the homeowner signs an AOB. The roofer's labor and materials are the consideration that makes the homeowner's assignment legally stick.

Here’s where it gets complicated. The rules for an assignment of benefits change dramatically depending on what state you're in. There’s no single federal law that governs AOBs. Instead, you're dealing with a patchwork of state laws and court rulings.

Take Florida, for example. After AOB-related lawsuits skyrocketed, the state enacted Florida Statute 627.7152, which imposed strict requirements. Now, AOBs in Florida must be in writing, contain a provision allowing the policyholder to cancel within 14 days, and include a detailed written estimate of the work to be performed.

Meanwhile, many other states are the complete opposite. They have very few specific AOB regulations and instead rely on general common law contract principles to figure things out. This can create a legal gray area, making the precise wording of the agreement that much more critical.

Even a well-drafted AOB can face a fight. Insurance carriers often challenge these agreements, looking for any loophole to deny payment.

Here are the usual suspects for challenging an AOB:

A core legal principle is that a contractor can't sue an insurance carrier directly without a valid assignment. The recent case Ace Roofing & Construction, Inc. v. Travelers drove this point home, ruling that without a proper assignment, the contractor had no legal standing to even bring a breach of contract claim.

This case is a perfect illustration of the stakes. A flawed assignment of benefits slams the door shut on the service provider, leaving them with no direct way to fight the insurance company for payment. You can read a great breakdown of how courts view this issue in this Property Insurance Coverage Law Blog analysis.

In the end, the strength of an AOB comes down to careful drafting and strict compliance with both general contract law and specific state rules.

An assignment of benefits stops being a dry legal concept and becomes a practical lifeline when disaster strikes. This is where you see an AOB in action, acting as a financial bridge that lets essential services begin immediately, without forcing a policyholder to pay massive sums out-of-pocket.

Whether your client was in a car wreck or woke up to a burst pipe, the immediate aftermath is chaotic. An AOB is designed to cut through that stress, but it's critical to understand how it functions in different contexts.

Let’s say your client was hurt in a car accident. They need weeks of physical therapy, but they don't have the cash to cover the bills while waiting for their PI claim to settle.

The client can sign an AOB with their physical therapist. In simple terms, this agreement gives the therapist the right to be paid directly from the final settlement funds.

This setup allows treatment to move forward on a promise of future payment.

A homeowner who discovers their basement is flooded. They need water mitigation services, and they need them now. That work can easily cost thousands of dollars upfront.

The homeowner calls a restoration company, which offers to start work immediately if the homeowner signs an AOB. By signing, the homeowner hands over their right to the insurance payout for that specific work. The restoration company can then get started and deal with the insurance adjuster themselves.

In a property damage claim, an AOB empowers the contractor to negotiate directly with the insurer. This can be a huge relief for a stressed-out homeowner, but it also means the contractor—not the policyholder—is in the driver's seat.

The global insurance market's climate plays a role here. The 2023 Global Insurance Market Report noted that while insurers in developing economies saw asset growth of 8.1% in 2022, they're also getting squeezed by inflation.

For both personal injury and property damage, the core trade-off is the same: you get immediate service in exchange for giving up a degree of control.

Key Advantages:

Potential Disadvantages:

An AOB is a powerful tool, but it's also a double-edged sword that demands careful thought before signing.

A poorly drafted assignment of benefits is a legal landmine. For attorneys, creating and scrutinizing these documents is a core duty that directly protects the client's settlement and the firm's bottom line. An airtight AOB is clear, compliant, and leaves no room for an insurer to wiggle out of its obligations.

This means moving beyond boilerplate text and thinking strategically about every single clause. The goal is to build a document that is both enforceable and transparent.

To be legally sound, an AOB needs more than a signature. Certain clauses are non-negotiable. Omitting them is asking for a challenge from an insurer.

Here are the absolute must-haves:

Let's break down how a few words can make all the difference.

Vague Clause (Avoid):

I hereby assign my insurance benefits to ABC Physical Therapy.

This is dangerously broad and easily challenged by an insurer.

Airtight Clause (Best Practice):

I, [Client Name], hereby assign and transfer to ABC Physical Therapy ('Assignee') my right to receive payment for medical services rendered in connection with my injuries from the motor vehicle accident of [Date of Accident]. This assignment is limited to the invoices attached hereto as Exhibit A and does not extend to any other policy benefits.

This version is specific, limited, and ties the assignment of benefits to a defined event and set of services. It’s far tougher for an insurer to dispute.

More often, you’ll be reviewing an AOB from a medical office or contractor. Scrutinizing these is critical. Speeding up this review is crucial, and understanding what is document automation can show how technology flags problematic clauses in seconds.

To help, I've put together a quick checklist comparing best practices with common red flags.

Think of this table as a quick reference guide when a third-party AOB lands on your desk.

Ultimately, a strong assignment of benefits comes down to clarity and foresight. By including these essential clauses and diligently spotting red flags, attorneys can ensure these agreements function as intended.

The world of personal injury settlements is a tangled web of financial and legal obligations. An assignment of benefits is a key piece, but it rarely stands alone. It often intersects with medical liens and the strict patient privacy rules of HIPAA, creating a landscape that demands careful navigation.

Getting this right is crucial for protecting your client’s settlement and keeping your firm compliant. Any misstep here can lead to payment disputes and serious privacy violations.

This is a common point of confusion, but an AOB and a medical lien are two fundamentally different legal tools. While both are used by providers to get paid from a settlement, they have different legal foundations.

An assignment of benefits is a voluntary contract. Your client proactively signs an agreement, willingly giving their right to insurance payments directly to a provider. For example, a client agrees with their chiropractor to assign a portion of their auto insurance medical benefits for treatment.

A medical lien, on the other hand, is often a statutory claim. It’s a legal right granted by state law that lets a healthcare provider place a claim against the settlement money. For example, many states have laws allowing hospitals to automatically file a lien for emergency services provided to an accident victim. It’s not a contract your client signs, but a formal notice filed against the case.

An AOB is a proactive agreement between two parties. A lien is a reactive, legally imposed claim against a future asset. Grasping this difference is fundamental to properly managing settlement distributions.

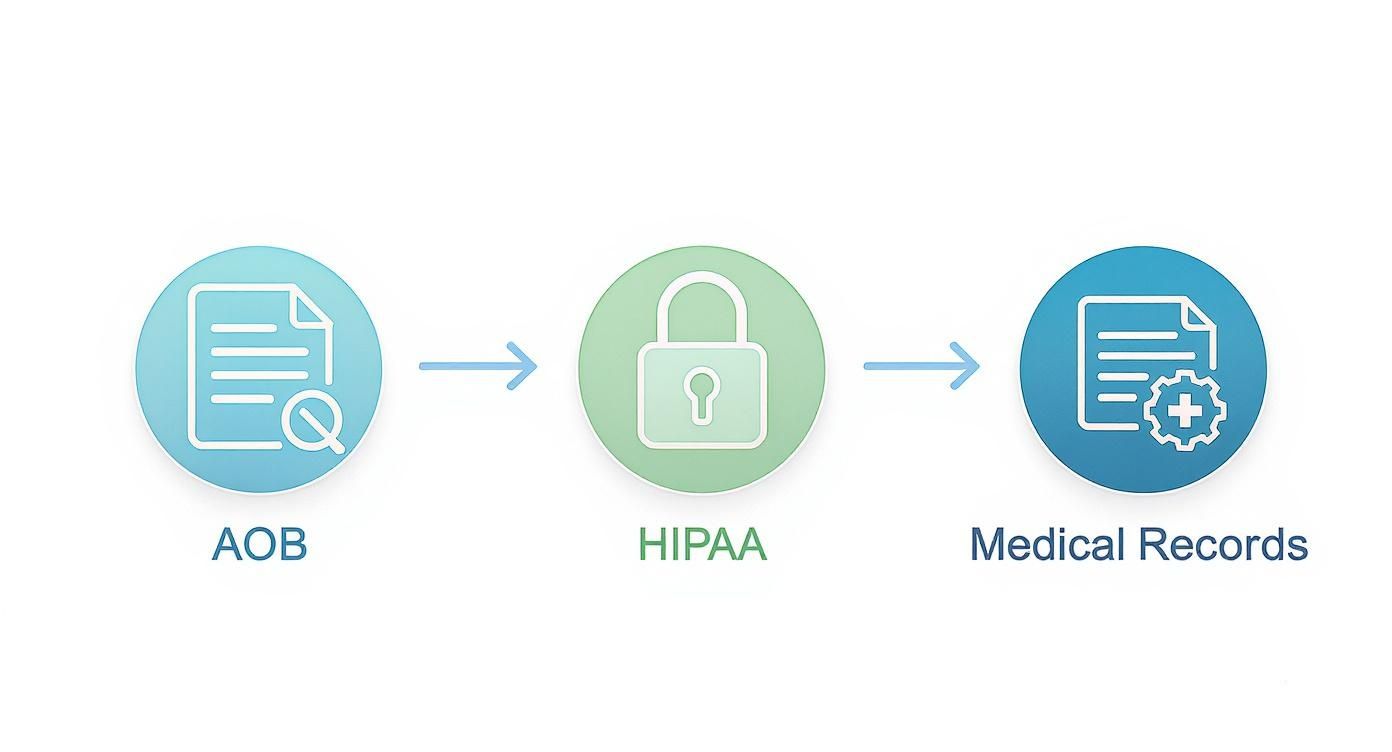

You can’t build a strong personal injury case without medical records. This is where HIPAA (the Health Insurance Portability and Accountability Act of 1996) enters the picture—and where a well-drafted AOB becomes more than just a payment tool.

A standard AOB by itself does not grant you access to protected health information (PHI). To get the records you need, the AOB must be paired with a separate, valid HIPAA authorization. This document gives the provider (and often, you, the attorney) explicit permission to access and share specific medical information.

Without a valid HIPAA release, a medical provider is legally handcuffed. Combining a clear AOB with a compliant HIPAA form creates a smooth, ethical workflow. For a deeper look into compliance strategies, our guide on proactive AI compliance offers valuable insights.

Managing these documents effectively prevents privacy breaches and keeps your case moving. The key is crystal-clear communication and airtight documentation.

A sloppy AOB or HIPAA form can create massive headaches. For example, a vague HIPAA release could lead to the oversharing of a client’s unrelated medical history, violating their privacy. Beyond just liens, navigating these privacy regulations is a core competency. You can learn more about ensuring regulatory compliance with an insurance-specific privacy policy to see how these principles apply.

Best Practices for Law Firms:

By treating AOBs, liens, and HIPAA compliance as interconnected parts of a single process, you can protect your client, build a stronger case, and uphold the highest ethical standards.

In a busy plaintiff firm, managing each assignment of benefits can quickly turn into an administrative nightmare. A messy, inconsistent process creates errors, slows down cases, and strains relationships with the medical providers your clients depend on. That's why building a solid, repeatable workflow is so important.

The process kicks off the moment you spot the need for an AOB, which is usually right at client intake. From there, it’s a journey of drafting the document, getting it signed, tracking it, and making sure the provider gets paid correctly from the settlement.

Trying to juggle dozens of AOBs with spreadsheets and calendar reminders is inefficient and risky. Thankfully, modern legal tech offers a much better way. AI-powered platforms like ProPlaintiff.ai can turn this administrative headache into a real strategic plus for your firm.

These tools are all about adding consistency and speed to your AOB process.

If you want to go deeper, check out our guide on legal contract management software to see how these systems can boost efficiency.

This diagram shows how it all fits together. The AOB is the key that, combined with a HIPAA authorization, unlocks the medical records you need to build the case.

It’s a great visual reminder that a signed AOB is just step one. It has to work hand-in-hand with a HIPAA release to give you the leverage you need.

Navigating an assignment of benefits agreement always sparks a few key questions. Getting the answers straight from the start is the best way to manage expectations and keep a case on track.

Here’s a quick rundown of the most common issues that come up.

Yes, but the clock is ticking. Many states that regulate AOBs, like Florida, build in a specific cancellation window. Under Florida Statute 627.7152, a policyholder has 14 days to rescind an AOB after it is executed, as long as the work has not yet begun.

Once that window closes and the provider has already started their work, it becomes much harder to undo. Any well-drafted AOB should spell out its cancellation terms clearly.

This is a big one. An AOB gives a provider the right to go after the insurance company, but it doesn't automatically get your client off the hook for the full bill.

If the insurer pays less than what the provider charges, the provider might try to bill your client for the rest. This is called "balance billing." For example, if a roofer’s bill is $15,000 but the insurer only pays $10,000, the roofer might try to collect the remaining $5,000 from the homeowner. A solid AOB must include language that explicitly protects your client from this.

When your client signs an assignment of benefits, they're essentially handing the keys to the provider to fight the insurance company. If the carrier denies the claim or lowballs the payment, it’s the provider’s job to negotiate or sue.

While this takes the fight off your client's plate, it also means you lose direct control over that specific negotiation. You're trusting the provider to handle it.

The key difference between an AOB and a medical lien comes down to how they’re created. An AOB is a voluntary contract your client signs. A lien, on the other hand, is a claim a provider files against a settlement based on state law, and it doesn't require a separate agreement.

Keeping these distinctions clear is fundamental to protecting your client's settlement and making sure there are no surprises down the road.

Ready to stop wrestling with documents and start winning cases? ProPlaintiff.ai generates compliant AOBs, reviews third-party agreements for risks, and organizes everything in one secure platform. See how our AI Paralegal can transform your firm's efficiency at https://www.proplaintiff.ai.